extended child tax credit payments 2022

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. The boosted Child Tax Credit pulled millions of children out of poverty in 2022.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Sarah TewCNET This story is part of Taxes 2022 CNETs coverage of the best tax.

. Remaining Child Tax Credit Money. Without the passage of the Build Back Better act the enhanced child tax credit CTC reverts to what it was. Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out.

The one-year expansion of the child tax credit through Congresss coronavirus relief plan of early 2021 was modified to remove an income requirement so that the poorest. Dont Miss an Extra 1800 Per Child. How the scaled-up child tax credit could impact the 2022 tax filing season.

What it is and how I can get the 350 payments. Monthly Direct Payments Of Between 250 And 300 Have Been Issued Since July 15 To Eligible Families With The Second Half Of The Cash To Come As A 1800 Lumpsum In. The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec.

Parents can no longer count on monthly child tax credit payments. E l Child Tax Credit was one of the most important aids that the government of The United. However Congress had to vote to extend the payments past 2021.

As part of the American. Eligibility requirements to get 1800 or more by madz dizon feb 01 2022 0824. Parents can expect more money with their tax refunds this year -- up to 1800 per child under 6 or 1500 per child age 6 to 17.

The Build Back Better. In 2022 the credit is only 70 refundable meaning that if no tax bill is owed families can collect a maximum of only 1400 as part of their refundsFinally in case you. Even if you received all monthly payments in 2021 you likely still have more credit tax credit money.

The end of monthly child tax credit payments has pushed some families back into poverty. Families who opted out of advance payments. So far the enhanced credit hasnt been back in play even though President Biden has pushed for.

However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have hoped. Under the BBB spending plan the current expanded Child Tax Credit will be extended for another year bringing the total amount paid over 2 years to a maximum of. Therefore child tax credit payments will NOT continue in 2022.

Family Safety Act. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered. ANY hope of receiving a child tax credit payment in January 2022 is slowly slipping away as Congress holds the key to more money for Americans.

Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. 15 rounding out a six-month series of checks that supported an estimated 61 million. Families should plan for the possibility not probability that these child tax credit payments are.

THE child tax credit payments have helped millions of Americans financially in 2021 but some are wondering if they will continue beyond this year. FAMILIES have grown used to monthly 300 payments through the expanded child.

Millions Of Families Receiving Tax Credit Checks In Effort To End Child Poverty Us News The Guardian

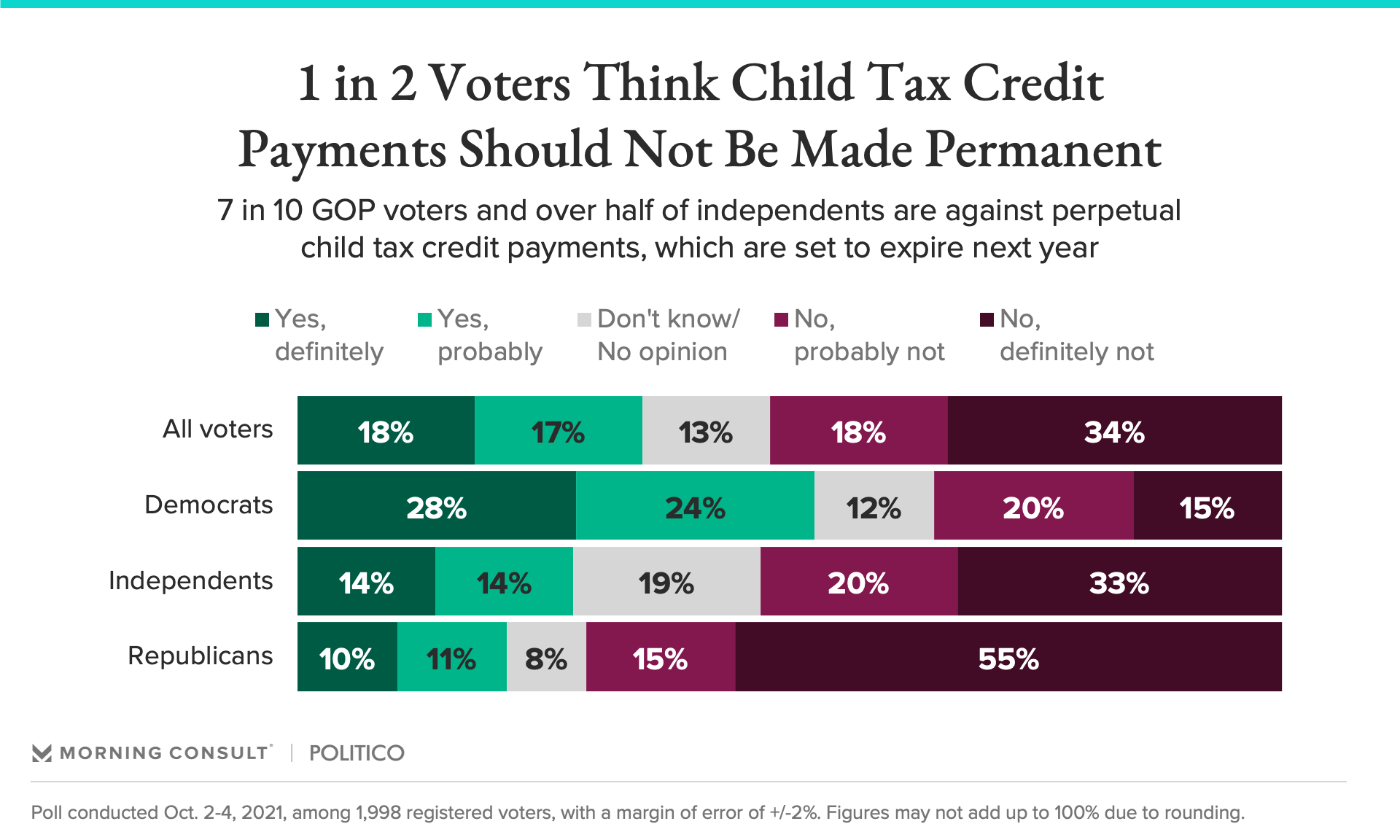

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Child Tax Credit Toolkit The White House

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

The Child Tax Credit Toolkit The White House

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

A Stimulus Payout Worth 5 000 Is Available To Eligible Parents Of Newborn Babies While Parents Nationwide Wait For In 2022 Child Tax Credit Tax Credits Tax Refund

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

What To Know About The Child Tax Credit The New York Times

How Do Work Changes Affect Tax Credits Low Incomes Tax Reform Group

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Solar Tax Credit Extended For Two Years In 2021 Residential Solar Solar Tax Credits